When I first began investing in the stock market, the year was 1995, and it was one big money-making party.

| Year | 1995 | 1996 | 1997 | 1998 | 1999 |

| S&P 500 return | 37% | 23% | 33% | 29% | 21% |

Source: https://www.slickcharts.com/sp500/returns

During this time, when I purchased a new stock, my two biggest questions were “how much will this go up?” and “should I sell half of my position now (locking in my gains), or let it ride, baby?”

Fast forward to today:

| Year | 2019 | 2020 |

| S&P 500 return | 31% | 18% |

Source: https://www.slickcharts.com/sp500/returns

Over the last two years, a similar surge of good stock market returns have left many people exuberant about their stock market portfolios.

So exuberant that one particular billionaire investor, Chris Sacca, tweeted this:

"To everyone who got into trading stocks this year, I have a little hard truth for you: You're not actually that good at it….You just caught a wild bull market. Take some money off the table."

This tweet received a backlash from angry new investors, leading to this follow-up tweet by Chris:

"To the angry Robinhood bros who got into trading stocks this year: I was wrong. You're amazing. This has nothing to do with the market. It's all you and your mad skillz. Don't take profits off the table. Double down, on margin. Borrow everything you can. Stocks never go down!"

Robinhood Bros?

The term “Robinhood bros” refers to the aggressive trading culture within the popular free trading app, Robinhood.

Robinhood allows investors to buy and sell stocks with $0 commission. A recent found that Robinhood investors traded 40 times more shares than Charles Schwab customers, sold 88 times more risky options contracts as Schwab customers, and over half of Robinhood customers were new to the stock market (average age of 31).

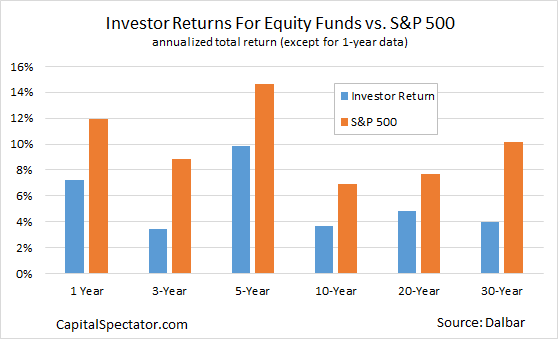

This high trading culture is likely bad for portfolio returns. Numerous studies have shown that over-trading causes individual investors to woefully underperform the stock market. Dalbar institute found that the average investor’s stock market investment return was 5.5% while the historical average annual return of the stock market (S&P 500 since 1929) was 9.9%.

The biggest contributor to that performance differential being investors’ failed effort to “time” the market, oftentimes being sucked into the market’s euphoria near market tops and “buying high” while subsequently succumbing to despondency near market lows and “selling low”.

Inferior returns for the average investor:

Source: https://www.capitalspectator.com/investor-returns-vs-market-returns-the-failure-endures/

A Slippery Slope

While the $0 commission fuels a temptation to over-trade, there is another, far more dangerous, temptation that is awakened: gambling addiction.

It was late into the night last year when Alex Kearns, 20 years old, collapsed into his bed and fell asleep. He had spent most of the evening trading his stock portfolio. When he awoke, his habit was to check his Robinhood balance, and so he opened the app. He had to blink a few times to recognize the balance: -$730,000. Upon seeing this horrifying result, Alex decided he had no way out and committed suicide, as .

While this true story may seem extreme, frequently trading stocks online has been shown to exactly mirror how gambling addiction works. In fact, frequently trading stocks online has been shown to meet the criteria for addiction according to the DSM-IV classification of psychiatric disorders, according to the “Journal on psychiatric research and addictions.”

According to another study, stock market gambling addiction starts with a number of small early wins followed by larger and more riskier investments. Trading, then, becomes the main activity of daily life. Financial losses tend to exacerbate this behavior since these traders are under the illusion that they are able to restore control and recover losses, as .

Unfortunately most of the current investors on Robinhood have experienced a number of small early wins (e.g., stock market, Gamestop, FAANG stocks). This has likely sown dangerous gambling addiction seeds. It is sobering to think about what is going to happen to this young generation of online stock traders when bigger stock market losses finally come due.

Stock Market Redemption

In today’s raging stock market, many investors assume that the stock market is a place where stocks only go up (just like my 90’s self). However, there is one crucial difference between the 1990’s and today: $0 commission. My 90’s self could only buy a position in a stock occasionally because brokers assessed a heavy commission on any odd-lot trade (a trade less than 100 shares). This commission made me trade fearfully and infrequently, knowing that it could wipe out all of my gains.

It was this fear of trading that was the key for me avoiding overtrading and gambling addiction.

But, how can an investor today develop this fear when there are no commissions? There are two key behaviors that need to happen:

1. Change your mindset to investor-owner

According to , the four criteria of gambling are: money betting, irreversible betting, a binary win or lose outcome, which depends entirely or partly on chance.

When you invest in the stock market, how much of what you are doing is dependent entirely on chance? If your time-frame is one day, one week, or even one month, it is very likely that most of what you are doing is entirely based on chance. Avoid this way of thinking by becoming an investor-owner.

An investor-owner thinks in terms of years, not days. They try to find productive assets to purchase that will most likely earn a sufficient rate of return. They understand that when you pay too much for something, you will likely have lots of risk with a very low expected return.

So, regarding the highly traded stock, Gamestop, a gambler will mostly look at the past return (+1,800%) and will relish the thrill of becoming a part of that fun ride. An investor-owner is a business-man who sees an increase in the stock price as a bad thing (paying more is bad). They will only purchase Gamestop shares if they are trading at a reasonable price given its level of expected revenue growth, earnings potential, and competitive advantages.

2. Only look at your portfolio once a month

Every time you open up a trading app and see red, it sends a signal of pain into your brain.

Behavioral finance has shown that a portfolio loss is twice as painful as a gain is pleasurable. This creates a gambling-type behavior known as “loss aversion” where people “double-down” on losing positions in order to avoid the painful sensation of losing money.

I don’t know about you, but I don’t like pain, so I simply only look at my portfolio values once-a-month. Since I am an investor-owner, and my investments are long-term investments, this works great for me. Stop-loss orders, or alerts, can always be added on certain positions.

By checking my portfolio just once a month, I feel so much less pain and I am much less likely to obsessively trade, in general. But, if your mind-set is anything other than an investor-owner, this discipline will likely not be possible for you.

One final thought: our role as investor-owner toward companies imitates God’s role as investor-owner toward us. God gives us His resources and asks us to manage them in a way that lets others know of His goodness, over a long period of time. When we invest in other companies, we should do the same. We are taking God’s money and letting the managers of companies manage it, with the hope that, over a long period of time, the products and services that we are helping to produce will help others know of God’s goodness.

Graphic by Justin Blake from the Noun Project; used by permission.

51¬Ð¿Ú

51¬Ð¿Ú

.jpg)

.jpg)